HP has announced that they will acquire floundering Palm for $1.2 billion at $5.70/share. A steal considering how profitable Palm can be with HP’s distribution channels and cash flow. A press conference is set for 5PM ET, which we’ll be covering live. After rumors that Palm CEO Jon Rubenstein would soon be outed it appears as though he will remain with the company.

This is a big win for both sides. HP has desperately been trying to enter into the mobile space for years with very little success in the US and marginal appeal overseas. With HP’s scale and resources, Palm actually has a chance of building out the webOS platform without the risk of being shut down for their patent portfolio as many had speculated would happen if HTC were to purchase the company. And, let’s face it, Lenovo wouldn’t know what to do with Palm and they appear to be invested in Android based on announcements made at CES this year.

But more importantly, the webOS platform is better suited on tablet devices, which HP is currently building on top of Windows 7. This is certainly the best case scenario for Palm and a huge win for HP.

When we asked a Palm employee what he/she/it thought of the announcement, he/she/it simply replied with “awesome”.

Update: We’re now on the conference call.

• HP expects the deal to close during their third fiscal quarter in an all-cash deal.

• HP plans to heavily invest in product development and aggressively drive Palm devices into the market.

• Tablets and netbooks will play an integral role in the development of webOS.

• The transaction will need to occur before either party are ready to disclose new product timelines, i.e. a webOS tablet.

• HP plans to operate Palm as a business unit. Rubinstein and the senior level team at Palm are all on board.

• Press conference is now over.

HP and Palm, Inc. (NASDAQ: PALM) today announced that they have entered into a definitive agreement under which HP will purchase Palm, a provider of smartphones powered by the Palm webOS mobile operating system, at a price of $5.70 per share of Palm common stock in cash or an enterprise value of approximately $1.2 billion. The transaction has been approved by the HP and Palm boards of directors.

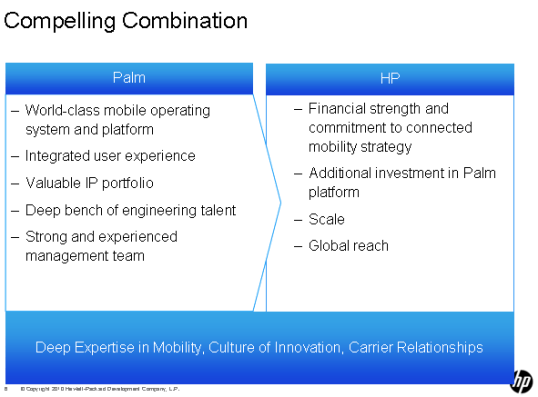

The combination of HP’s global scale and financial strength with Palm’s unparalleled webOS platform will enhance HP’s ability to participate more aggressively in the fast-growing, highly profitable smartphone and connected mobile device markets. Palm’s unique webOS will allow HP to take advantage of features such as true multitasking and always up-to-date information sharing across applications.

“Palm’s innovative operating system provides an ideal platform to expand HP’s mobility strategy and create a unique HP experience spanning multiple mobile connected devices,” said Todd Bradley, executive vice president, Personal Systems Group, HP. “And, Palm possesses significant IP assets and has a highly skilled team. The smartphone market is large, profitable and rapidly growing, and companies that can provide an integrated device and experience command a higher share. Advances in mobility are offering significant opportunities, and HP intends to be a leader in this market.”

“We’re thrilled by HP’s vote of confidence in Palm’s technological leadership, which delivered Palm webOS and iconic products such as the Palm Pre. HP’s longstanding culture of innovation, scale and global operating resources make it the perfect partner to rapidly accelerate the growth of webOS,” said Jon Rubinstein, chairman and chief executive officer, Palm. ”We look forward to working with HP to continue to deliver industry-leading mobile experiences to our customers and business partners.”

Under the terms of the merger agreement, Palm stockholders will receive $5.70 in cash for each share of Palm common stock that they hold at the closing of the merger. The merger consideration takes into account the updated guidance and other financial information being released by Palm this afternoon. The acquisition is subject to customary closing conditions, including the receipt of domestic and foreign regulatory approvals and the approval of Palm’s stockholders. The transaction is expected to close during HP’s third fiscal quarter ending July 31, 2010.

Palm’s current chairman and CEO, Jon Rubinstein, is expected to remain with the company.