Facebook is buying WhatsApp, the wildly popular communications app for smartphones that has 450 million users a month. The price it’s paying is $19 billion: $12 billion in Facebook stock, $4 billion in cash and $3 billion in restricted stock units. Even in an era of stunning prices for hot startups, that’s a stunner. (Was it really less than two years ago that the $1 billion Facebook paid for Instagram sounded like an epic price?)

This is by far the biggest tech-related deal since AOL agreed to buy Time Warner in 2000 for $160 billion — a deal that was far more epic, but which involved venerable, highly profitable assets such as TV networks, movie studios, cable-TV systems and (*cough cough*) magazines rather than one really popular app.

WhatsApp was formed in 2009 and is profitable, even though it spurns advertising: After the first year, it charges users a service fee of 99 cents a year. It’s already been disrupting the test-messaging business, historically a cash cow for wireless carriers. But what Facebook is buying is the potential WhatsApp has to grow even further, until it matches or exceeds Facebook’s own scale and impact. (Facebook says it’s going to leave WhatsApp’s brand and management alone, much as it’s done with Instagram.)

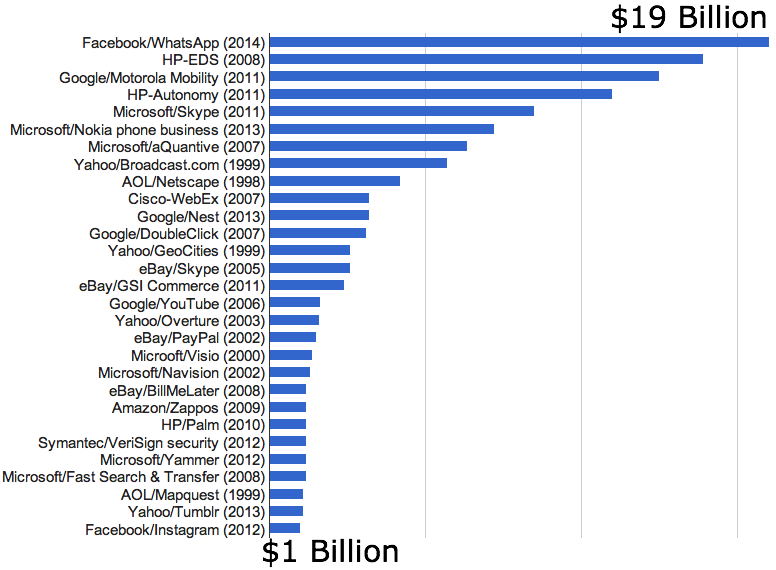

If you try to compare this acquisition with other big acquisitions of tech startups, you quickly realize that in terms of scale, there really is no comparison. Here’s an incomplete list of other deals north of $1 billion made over the past 15 years, mostly involving the purchasing of a startup superstar by a large, well-established tech company. None of them reach the total of $19 billion that WhatsApp is getting, and the one that comes closest — HP’s acquisition of EDS — involved an acquisition of a company that was making around $22 billion a year in revenue.

Just scanning this list is sobering: While there are some acquisitions in there that look like steals in retrospect (such as YouTube), it’s possible that the majority were lousy ideas, at least at the price paid. (In some instances that was even pretty obvious when the deal was done.) In this case, Facebook owning WhatsApp makes a world of sense. Just as important, so does Facebook preventing some other big Silicon Valley company from snapping it up. So the big question involves that doozy of a price tag — and it may be years before we know for sure whether it was a sound investment.