As rumored, Google has officially announced its new mobile payment system. The platform is called “Google Wallet” and is a joint venture between Google, MasterCard, Sprint and security company First Data.

The system is currently available on just a single phone—the Nexus S 4G from Sprint—and works with MasterCard’s “PayPass” tap-to-pay kiosks in New York and San Francisco.

“We are just getting started. This will take a while to come to fruition,” said a Google rep during a demonstration in New York today.

How It Works

Google Wallet will live as an app on the Nexus S smartphone. When you first launch the app, you’ll be asked to attach your Google Wallet to your Google account and then you’ll enter your credit card information. Initially, the system supports the Citi MasterCard and a Google debit card that can have funds added to it from any other credit card.

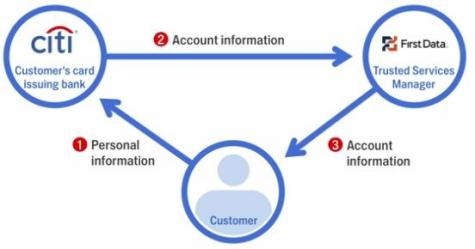

When you add your Citi MasterCard, Citi verifies the card with First Data, which then “provisions” the card (gives it the okay) to be used by your phone.

As for retail transactions, provided the store you’re shopping at has a PayPass-enabled terminal, you’ll be able to tap your phone against the terminal to have the money withdrawn from your account.

Security

On the software side, your phone will have to have its screen manually unlocked, the Google Wallet app will have to be opened, you’ll have to enter a PIN number and you’ll be able to set a spending limit. For instance, transactions over $100 can be verified with you via text messages or e-mails first. The credit card data itself is encrypted and your credit card number is never fully displayed on your phone’s screen.

(See Also: Google Wallet Is Coming. Don’t Be Afraid.)

On the hardware side, the near-field communications (NFC) chip used in the phone is the same type of smartcard chip used for passports and tap-to-pay credit cards. The chip will self-destruct if it’s physically tampered with, should someone attempt to crack open your phone and extract it.

Google “Offers”

Google will also be launching it’s own daily deals initiative, called “Offers.” Offers will be delivered to your e-mail inbox as an offer of the day and can also accessed from your Google Wallet.

Aside from the standard daily offers from Google, participating merchants will be able to offer reward-based deals via physical check-ins using Google “Places” and online ads. Furthermore, if you see an offer you like online, you’ll be able to save it to your phone like a digital coupon. You’ll then be able to redeem the offer by tapping your phone at the merchant’s point of sale or by showing your phone to the cashier.

The Google Offers-Google Wallet tie-in will roll out in Portland (Oregon), San Francisco and New York this summer.

Future Features

Eventually you’ll be able to put everything in your Google Wallet—your drivers license, loyalty cards, and other credit cards. Google is pushing its platform as an open one, so other retailers, credit card companies and phone manufacturers can hop on board as they see fit.

Read More: Google Wallet [Google.com]