The tablet category is quickly becoming a tricky one to analyze. As in the early stages of any technology category, we are seeing the tablet market splinter into separate markets.

While I like to point out how large the tablet category is, one can’t accurately analyze the tablet category without peeling back its onion-like layers.

As I and other analysts have continued to point out, the tablet market is really two separate categories. In fact, it may actually be more than that. The challenge that we have is that the generic term “tablet” is actually a term that means many different things to different segments of the market. For example, a tablet that is purchased only to mount in a retail store is lumped into the tablet sales estimates with products like the iPad, Nexus, Kindle Fire, Samsung Galaxy Tab and so on. So while point of sale tablets will be counted among tablets that get sold to end users and are used, we have to wrestle with the question of whether they should be or not.

The same is true with the many low-cost tablets that are flooding the market but aren’t really showing up on anyone’s radar. These devices, to the best of our knowledge, are really more appliances and dedicated-use tablets that have weak specs, low-res screens, cheap casing and are primarily being used in emerging markets to just watch movies. These tablets don’t go online, don’t connect to anyone’s services and don’t download apps, so should they be counted in the same numbers as iPads, Samsung tablets and Kindle Fires?

This is the challenge we are faced with in understanding the tablet market. When you study it as I do, you see what is happening in the market but you also know it is somewhat disingenuous to make a bold claim of how big the tablet market is or how many tablets we are selling when not all tablets are created equally or being used equally.

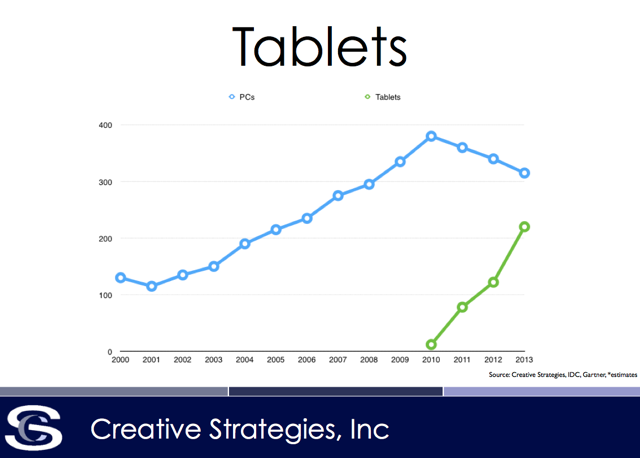

This complicates things even more with the “tablets are replacing PCs” narrative. For example, here is my chart including historical sales, current estimates and our forecasts for PCs and tablets the next few years.

When you look at all the graphs pointing to tablet sales growing and PC sales shrinking, it looks very bleak for the PC. And there is some truth to this. However not all these tablets are being used to replace the PC. I believe a percentage are, but not all of them. In many cases, the bulk of tablets sold are being used to compliment PCs. Then there are those being used in markets by people who do not own a PC, and these devices are not being used in PC-like ways at all. More importantly, they couldn’t be used like a PC even if the person wanted to. In this light, and for the moment, comparing tablet sales to PCs is more inaccurate than it is accurate.

Now, while there is some truth to the critique that sometimes people buy PCs and don’t use them to do PC things either, the counter point is that those same consumers are using a machine capable of computing even if they’re not using all its power. The low-cost tablets I am pointing out do nothing but watch movies, are not capable of doing much more due to their low-cost underpowered CPU and are not capable of much computing.

In this regard, I propose we look at low-cost tablets in a similar light as netbooks. If you recall, a netbook was, in essence, a truncated PC. It looked like a PC but failed miserably when someone tried to use it like a PC. Hence the astronomical return rates we saw in the early netbook days. Netbooks were treated as second-class citizens to PCs by everyone who made them, and also by retailers. The term itself was invented to try and call these devices out separately as to not confuse consumers into thinking they were PCs.

The same issue now exists with these low-cost tablets. Consumers who have bought them and tried to use them like higher priced tablets have been disappointed. These devices are simply weak tablets in the same ways the netbook was a weak PC. Both barely sufficed for a few tasks and were extremely limited in their use cases.

Now, while there is a place for these devices — which are dedicated consumption devices primarily — we can’t confuse them with the big shift of computing from notebooks to tablets capable of more computing like the iPad Air or the Surface Pro or any number of more powerful, larger-screen tablets coming from the Windows ecosystem.

As you can tell from some of the reviews of these tablets, like this one from Walt Mossberg, you see that these devices are being described very similar to netbooks. People need to understand the difference between a budget tablet and the ones that are capable of more things. For some who just want to use a tablet in very simple ways, perhaps a budget tablet is the way to go. But in this regard, they are being bought for a specific purpose, whereas other tablets are capable of being more general purpose computing devices.

For those of us who track and count these things, the tablet market is more complex and filled with variety than many other segments we have tracked before. The key to understanding the tablet market is its layers. And it has more layers right now than any other.

Bajarin is a principal at Creative Strategies Inc., a technology industry analysis and market intelligence firm in Silicon Valley. He contributes to the Big Picture opinion column that appears here every week on TIME Tech.